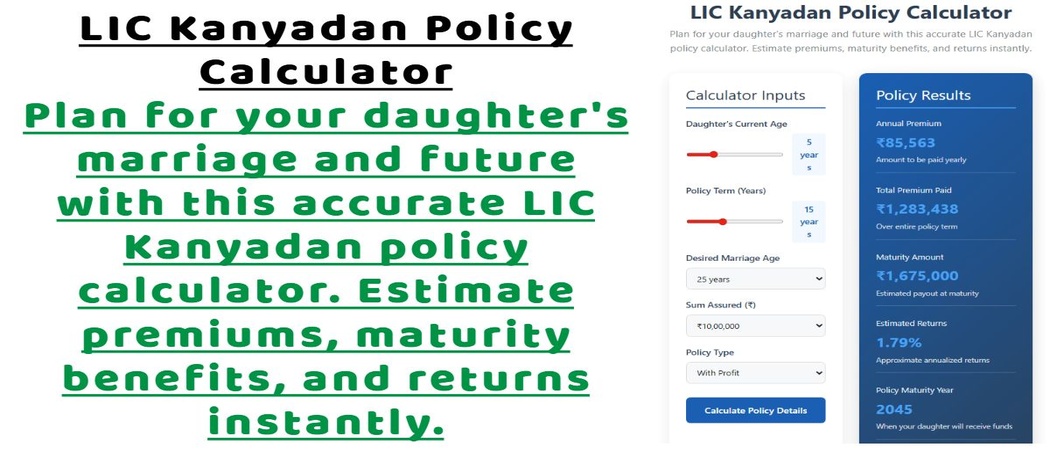

LIC Kanyadan Policy Calculator

Plan for your daughter's marriage and future with this accurate LIC Kanyadan policy calculator. Estimate premiums, maturity benefits, and returns instantly.

Calculator Inputs

Policy Results

Note: These calculations are estimates based on standard LIC rates. Actual values may vary based on final bonuses and policy conditions.

Accurate Calculations

Get precise estimates of premiums, maturity amounts, and returns based on current LIC rates.

Financial Planning

Plan for your daughter's future with confidence using our comprehensive calculator.

Easy to Use

Simple interface with sliders and dropdowns to adjust parameters instantly.

LIC Kanyadan Policy: A Comprehensive Guide for Your Daughter's Future

The LIC Kanyadan Policy is a thoughtful insurance plan designed specifically for parents who want to secure their daughter's future, particularly for her marriage expenses. In a country like India where weddings are significant cultural events that often require substantial financial planning, this policy provides a disciplined savings approach with insurance coverage.

What is LIC Kanyadan Policy?

LIC Kanyadan Policy is a non-linked, with-profit endowment plan that offers both protection and savings. The policy is taken by parents on their own lives for the benefit of their daughter. The sum assured, along with accrued bonuses, is payable either on the death of the parent or on the policy's maturity, whichever occurs earlier. This ensures that the daughter's future is financially protected even in the unfortunate event of the parent's demise.

Key Benefits of LIC Kanyadan Policy

- Financial Security for Marriage: The policy matures when the daughter reaches the specified age (between 18-30 years), providing funds exactly when needed for marriage expenses.

- Death Benefit: If the parent passes away during the policy term, the sum assured is immediately paid to the nominee, ensuring the daughter's future remains secure.

- Bonus Accumulation: As a with-profit policy, it participates in the profits of LIC and receives bonuses which significantly enhance the maturity value.

- Loan Facility: After the policy acquires a surrender value, you can avail a loan against it for emergency needs.

- Tax Benefits: Premiums paid qualify for tax deductions under Section 80C, and the maturity amount is tax-free under Section 10(10D) of the Income Tax Act.

How the LIC Kanyadan Policy Calculator Works

Our LIC Kanyadan Policy Calculator helps you estimate the premium amounts and maturity benefits based on key parameters like your daughter's current age, desired marriage age, sum assured, and policy type. The calculator uses LIC's current bonus rates and mortality charges to provide realistic estimates, helping you make informed decisions about your financial planning.

When you adjust the sliders for daughter's age or policy term, the calculator instantly recomputes the annual premium, total outgo, and expected maturity amount. This helps you visualize how different parameters affect your financial commitment and the eventual payout your daughter will receive.

Planning Strategies with LIC Kanyadan Policy

For optimal results, consider starting the policy when your daughter is young. The earlier you begin, the lower your premiums will be due to the longer premium payment term. Additionally, a longer policy term allows more time for bonus accumulation, significantly enhancing the final maturity value.

Many parents combine the LIC Kanyadan Policy with other investment instruments like mutual funds or fixed deposits to create a comprehensive marriage fund. The insurance component of this policy provides the necessary risk cover, while the savings component ensures disciplined accumulation of funds specifically earmarked for your daughter's wedding.

Why Our LIC Kanyadan Calculator Stands Out

Unlike generic insurance calculators, our tool is specifically designed for the LIC Kanyadan Policy with accurate parameters that reflect the unique features of this plan. We regularly update our calculation algorithms based on LIC's latest bonus declarations and policy terms to ensure you get the most realistic estimates possible.

Our calculator is completely free to use with no registration required, and we don't store any of your personal data or calculation inputs. The tool works entirely in your browser, ensuring complete privacy while you plan for your daughter's future.

Final Thoughts

The LIC Kanyadan Policy represents more than just an insurance product—it's an expression of parental love and responsibility. By systematically setting aside funds for your daughter's marriage, you're not only ensuring financial preparedness but also peace of mind that her future is secure regardless of life's uncertainties.

Use our calculator to explore different scenarios and find the perfect balance between affordable premiums and adequate coverage. Remember that while this policy provides a solid foundation for marriage planning, it should be part of a broader financial strategy that includes emergency funds, health insurance, and other long-term investments.

© 2025-26 LIC Kanyadan Policy Calculator | This is an independent tool not affiliated with LIC of India. All calculations are estimates. For exact policy details, please contact LIC.