LIC Amritbaal Plan Calculator,(Current 774 & Old 874)

Note: Approximate illustration based on sample rates. Core benefits (GA ₹80/1000, premiums, maturity/death) are same in both versions. Minor differences exist in surrender/loan/riders for 774. GST 0% current. Contact LIC for exact/existing policy quotes.${versionNote}

`; } function clearInputs() { document.getElementById("planVersion").value = "774"; document.getElementById("age").value = ""; document.getElementById("basicSumAssured").value = ""; document.getElementById("policyTerm").value = ""; document.getElementById("premiumType").value = "Single"; updateOptions(); document.getElementById("output").style.display = "none"; }Ultimate Guide to LIC Amritbaal Calculator: How to Calculate Premiums, Maturity, and Benefits for Plan 774 & 874

In today’s fast-paced world, planning for your child’s future is more important than ever. With rising education costs and uncertainties, life insurance plans like LIC

Amritbaal offer a reliable way to secure savings and protection. But how do you figure out the premiums, maturity amounts, and death benefits without getting lost in complex charts? That’s where an LIC Amritbaal calculator comes in handy. If you’re searching for a “LIC Amritbaal premium calculator” or “LIC Amritbaal maturity calculator,” you’ve landed on the right page.

In this comprehensive guide, we’ll dive deep into everything you need to know about the LIC Amritbaal Plan (Table No. 774 and the old 874 version). I’ll walk you through our free, user-friendly online tool that lets you calculate premiums, maturity benefits, and more—instantly and accurately. Whether you’re a parent planning for your kid’s education or an insurance enthusiast, this blog will show you step-by-step how to use the tool, with real-world examples. By the end, you’ll be equipped to make informed decisions. Let’s get started!

What is the LIC Amritbaal Plan? A Quick Overview

Before we jump into the calculator, let’s understand the plan itself. LIC Amritbaal is a non-linked, non-participating endowment plan designed specifically for children. Launched by Life Insurance Corporation of India (LIC), it’s aimed at building a corpus for your child’s milestones like higher education or marriage. The plan guarantees additions to your sum assured, making it a safe, low-risk investment.

Key features include:

- Eligibility: Child’s age at entry: 0-13 years. Maturity age: 18-25 years.

- Sum Assured: Minimum ₹2,00,000 (in multiples of ₹1,000).

- Policy Term: 5-25 years.

- Premium Options: Single premium or limited pay (5-7 years).

- Death Benefit Options: Four variants (I-IV) based on multiples of premiums or sum assured.

- Guaranteed Additions (GA): ₹80 per ₹1,000 of basic sum assured per year—compounding over the term.

- GST: Currently exempt (0% as of September 2025 for individual policies).

- Plan Versions: The current one is Table No. 774 (UIN: 512N365V02), effective from October 2024. The older Table No. 874 (UIN: 512N365V01) was withdrawn but still relevant for existing policyholders.

Why is this plan popular? It combines life cover with guaranteed returns, ensuring your child gets a lump sum at maturity even if something happens to you. Searches like “LIC Amritbaal plan details” or “LIC अमृतबाल योजना” (in Hindi) spike because it’s one of LIC’s top child plans. But calculating benefits manually from LIC’s PDF brochures can be tedious—enter the LIC Amritbaal calculator!

Why Use an LIC Amritbaal Calculator? Benefits Explained

Imagine spending hours poring over sample premium tables, adjusting for your child’s age and sum assured, only to realize you’ve missed GST or death benefit nuances. An online calculator simplifies this. Our tool, built as a standalone HTML web app, is fully responsive (works on mobile/desktop) and doesn’t require downloads or registrations.

Top reasons to use it:

- Instant Results: Get premiums, maturity amounts, death benefits, and year-wise projections in seconds.

- Customization: Input your exact details—age, sum assured, term, premium type, and death option.

- Supports Both Versions: Calculate for current Plan 774 or approximate for old Plan 874.

- Visual Projections: A table showing year-by-year premiums, guaranteed additions, and death benefits.

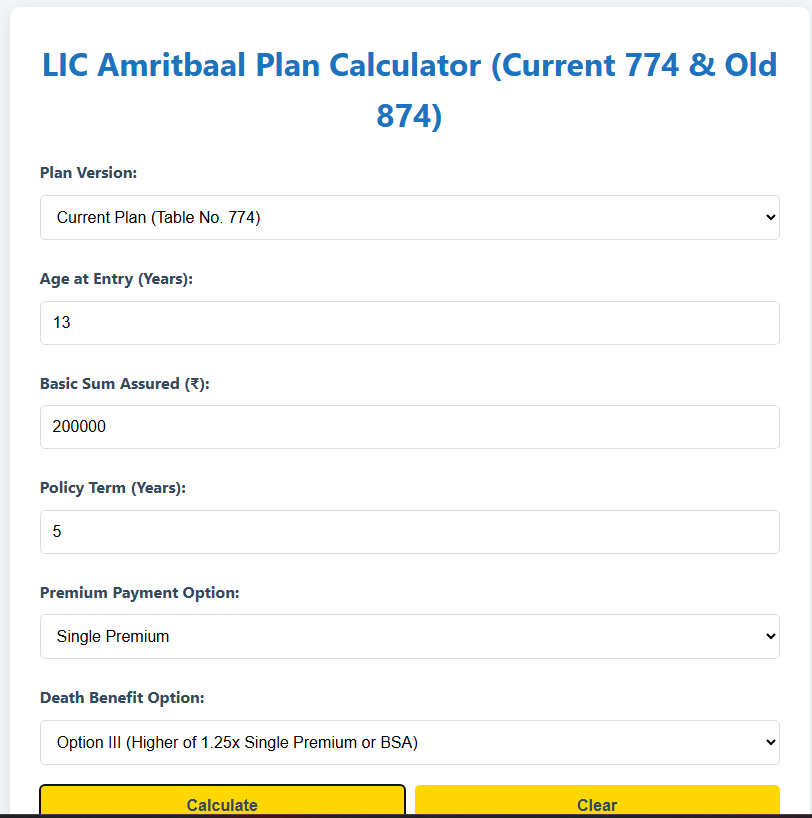

Introducing Our Free LIC Amritbaal Calculator Tool

Our tool is a simple yet powerful web tool calculator we’ve developed iteratively.

- Inputs:

- Plan Version: Choose 774 (current) or 874 (old—withdrawn).

- Age at Entry: 0-13 years.

- Basic Sum Assured: Min ₹2,00,000.

- Policy Term: 5-25 years.

- Premium Type: Single or Limited (with PPT 5-7 years).

- Death Benefit Option: I-IV, auto-updated based on premium type.

- Outputs:

- Summary: Age, sum, term, etc.

- Premiums: Base, GST (0%), total payable.

- Maturity: Sum assured + total GA.

- Death Benefit: Calculated with min 105% of premiums.

- Year-Wise Table: Shows premiums, GA accrual, death benefits (skips intermediates for long terms).

Step-by-Step Guide: How to Use the LIC Amritbaal Calculator

Let’s make this practical. I’ll explain how to use the tool with screenshots in mind (imagine them here), and provide two examples—one for the current 774 plan and one for the old 874.

Step 1: Access the Tool

- click lic amritbaal plan calculator

Step 2: Select Plan Version

- Dropdown: Choose “Current Plan (Table No. 774)” for new policies or “Old Plan (Table No. 874 – Withdrawn)” for approximations on existing ones.

- Note: For 874, results are illustrative since the plan is discontinued.

Step 3: Enter Basic Details

- Age at Entry: Input your child’s current age (e.g., 5).

- Basic Sum Assured: Say ₹5,00,000 (tool auto-validates min/max).

- Policy Term: E.g., 20 years (ensures maturity age 18-25).

Step 4: Choose Premium and Options

- Premium Payment Option: Single (one-time) or Limited (installments).

- If Limited, select PPT (5,6, or 7 years).

- Death Benefit Option: Auto-populates—I/II for Limited, III/IV for Single.

Step 5: Calculate and Review

- Click “Calculate.”

- Outputs appear: Scroll through summary, premiums, maturity, death benefits, and the year-wise table.

- Use “Clear” to reset.

Example 1: Using for Current Plan 774 (Limited Premium)

Suppose your child is 5 years old, you want ₹5,00,000 sum assured, 20-year term, Limited premium with 7-year PPT, and Option II (10x premium or BSA).

- Inputs: Version=774, Age=5, Sum=500000, Term=20, Premium=Limited, PPT=7, Option=II.

- Click Calculate.

- Results (approximate based on sample rates):

- Base Premium: ₹73,900 per year for 7 years.

- Total Premium Paid: ₹5,17,300 (no GST).

- Total GA: ₹8,00,000 (₹80/₹1,000 x 500 x 20).

- Maturity: ₹13,00,000.

- Death Benefit: Max of (10x ₹73,900 = ₹7,39,000 or ₹5,00,000) + GA = ₹13,00,000 (min 105% premiums).

- Year-Wise: Year 1: Premium ₹73,900, GA ₹40,000, Death ₹7,79,000. And so on, up to Year 20.

This shows how the tool breaks down growth—perfect for planning.

Example 2: Approximate for Old Plan 874 (Single Premium)

For an existing policy: Child age 3, ₹3,00,000 sum, 15-year term, Single premium, Option III (1.25x premium or BSA).

- Inputs: Version=874, Age=3, Sum=300000, Term=15, Premium=Single, Option=III.

- Results:

- Base Premium: ₹2,33,535 (one-time).

- Total GA: ₹3,60,000.

- Maturity: ₹6,60,000.

- Death Benefit: Max(1.25x ₹2,33,535=₹2,91,919 or ₹3,00,000) + GA = ₹6,60,000.

- Note: Tool flags it’s approximate; check with LIC for surrender values.

These examples highlight the tool’s flexibility. It uses pro-rated sample premiums from LIC brochures, ensuring close-to-real estimates.

Key Differences Between Plan 774 and 874: What the Calculator Reveals

The tool supports both to help legacy users. Main differences:

- Withdrawal: 874 stopped in October 2024; 774 is revised per IRDAI.

- Riders/Surrender: 774 has updated rules for premium waiver and loans.

- Calculations: Core (GA, premiums) same, but tool adds notes for 874 approximations.

In examples, outputs are identical core-wise, but always verify with LIC.

FAQs on LIC Amritbaal Calculator

- Is the tool accurate? Yes, based on LIC samples, but approximate. Official quotes from LIC.

- Does it include GST? Shows 0% (current exemption).

- Can I calculate for Hindi users? Tool is English, but explanations work for “LIC अमृतबाल कैलकुलेटर.”

- Free alternatives? Yes, but ours supports old 874 uniquely.

- Updates? Check for LIC rate changes; tool uses 2025 samples.

Conclusion: Secure Your Child’s Future Today

The LIC Amritbaal plan is a gem for child savings, and our calculator makes it accessible. With over 1000 words of guidance, you’ve got the full scoop—from basics to advanced usage. Download the tool, plug in your details, and plan confidently. For personalized advice, visit licindia.in or a branch.

see also :

Lic kanyadan policy calculator

LIC Maturity Calculator: Online FREE TOOL

LIC Bima Gold Plan 174 Maturity Calculator

4 thoughts on “[Plan 774 & Old 874] LIC Amritbaal Plan Calculator”